Please see Department publication Sales & Use Tax Topics: Leases for additional information regarding the tax treatment of leases.

Forms and instructions are available online at /forms-in-number-order.

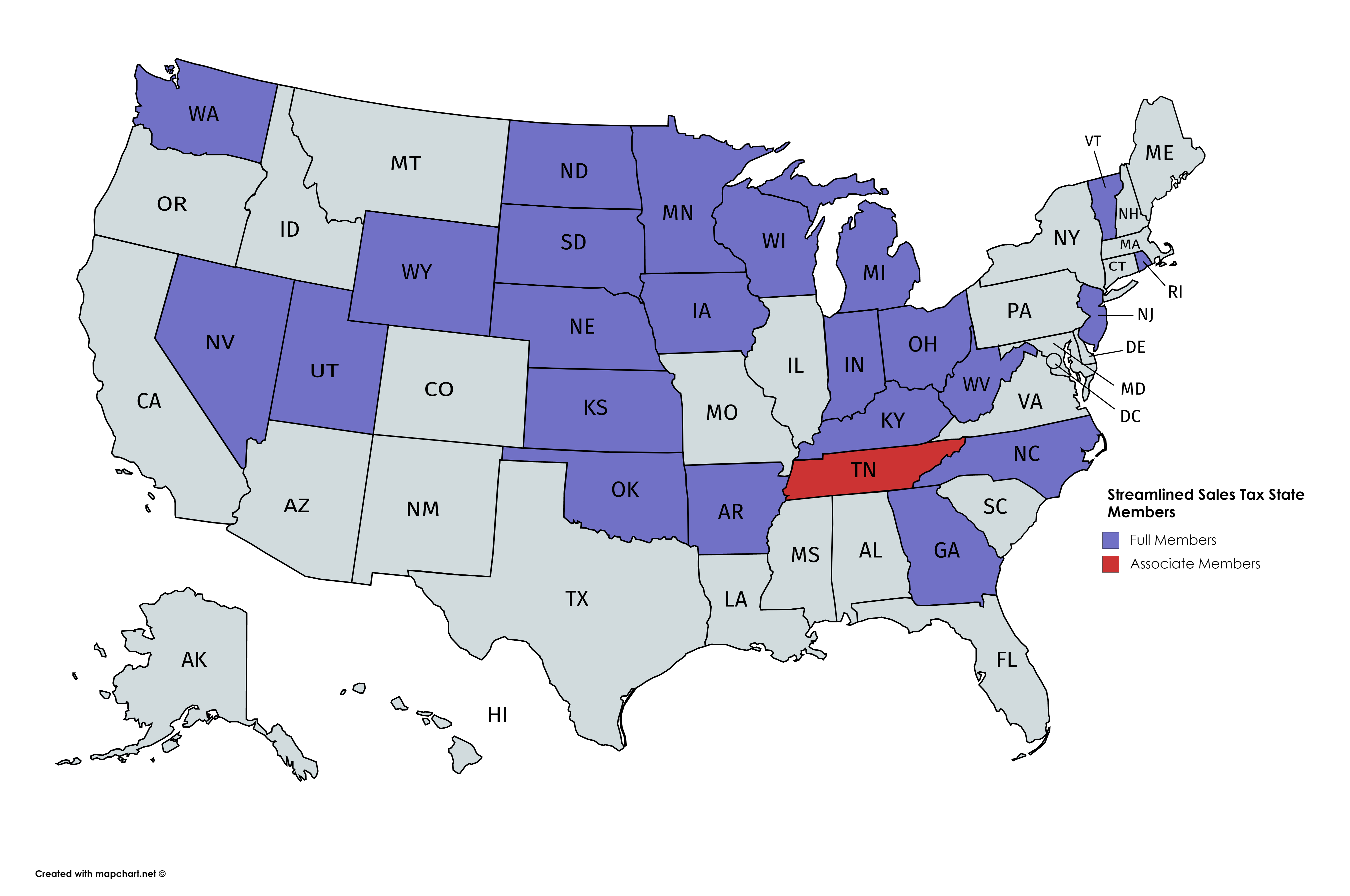

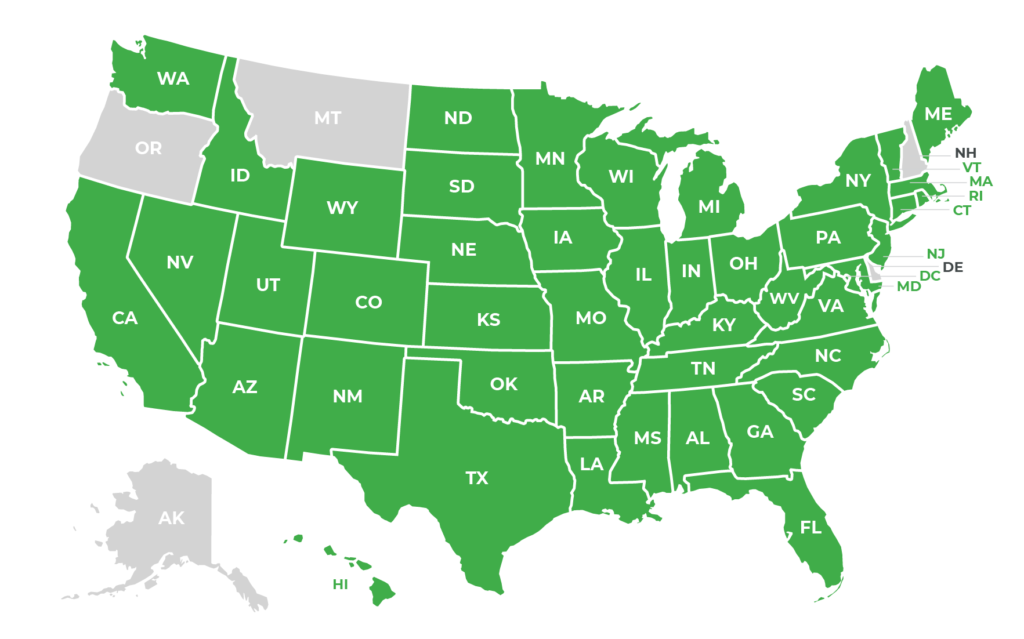

Steam sales tax states registration#

A lessor may submit a completed Lessor Registration for Sales Tax Collection (DR 0440) to the Department to request permission to acquire tangible personal property tax-free on the condition that the lessor agrees to collect sales tax on all lease payments received on the property. However, a lease for a term of 36 months or less is tax-exempt if the lessor has paid Colorado sales or use tax on the acquisition of the leased property. In general, leases of tangible personal property are considered retail sales and are subject to Colorado sales tax. Please see the Colorado Consumer Use Tax Guide for additional information. If a wholesaler or retailer makes a tax-free wholesale purchase of an item for resale, but subsequently withdraws that item from inventory for their own use, they will owe use tax on that item. A sale by a wholesaler or jobber to an end user or consumer is a retail sale and not a wholesale sale. Sales of ingredients or component parts to manufacturers for incorporation into a product for sale to an end user or consumer are also regarded as wholesale sales (for additional information, please see Department publication Sales & Use Tax Topics: Manufacturing available online at /sales-use-tax-guidance-publications).

A wholesale sale is a sale by a wholesaler or jobber to a retail merchant, jobber, dealer, or other wholesaler for the purpose of resale. Retailers are encouraged to consult their tax advisors for guidance regarding specific situations.Įvery sale that is not a wholesale sale is a retail sale. Nothing in this publication modifies or is intended to modify the requirements of Colorado’s statutes and regulations.

Steam sales tax states license#

Additional information about license applications and renewals, filing options, forms, and instructions can be found online at /sales-use-tax. This publication is designed to provide retailers with general guidance regarding sales tax licensing, collection, filing, remittance, and recordkeeping requirements prescribed by law. Retailers must maintain all records necessary to determine the correct amount of tax and provide these records to the Department upon request.

They must also file returns and remit collected taxes at regular intervals, generally on a monthly basis. A retailer may be required to collect tax even if it has no physical presence in Colorado.Īny retailer that is required to collect Colorado sales tax must obtain and maintain a Colorado sales tax license. The requirement to collect tax applies regardless of whether the sale is made at a retailer’s location in Colorado or delivered to the customer at a location in Colorado. In general, any retailer making sales in Colorado is required to collect the applicable state and state-administered local sales taxes. The information in this publication pertains only to state and local sales taxes administered by the Colorado Department of Revenue. However, the Department does not administer and collect sales taxes imposed by certain home-rule cities that instead administer their own sales taxes. The Colorado Department of Revenue administers not only state sales tax, but also the sales taxes imposed by a number of cities, counties, and special districts in Colorado. However, in the case of a mixed transaction that involves a bundled sale of both tangible personal property and service (whether or not such service is specifically taxed), the entire purchase price may be taxable unless certain conditions exist. In general, the tax does not apply to sales of services, except for those services specifically taxed by law.

0 kommentar(er)

0 kommentar(er)